Dividends stocks also lend the much-needed stability to a portfolio. The dividend yield acts as a buffer against volatility.

What may seem peripheral can sometimes be more exciting than the core. Delhi-based Fatehchand Rathore, 45, has invested nearly Rs 6 lakh in stocks over the past 18 years. While his stock investments have gained 400%, Rathore has earned an eye-popping Rs 10 lakh in dividends alone.

“I have already got back more than 165% of my principal,” says the Mumbaibased chartered accountant. In another part of India’s financial capital, 62-year-old Dildar Singh Makani is poring over the pink newspapers. Makani, a retiree, is trying to identify the stocks with the highest dividend yields.

The dividend yield is the dividend payout from a stock as a percentage of the share price. If a stock priced at Rs 50 offers a dividend of Rs 2 per share, the dividend yield works out to 4% (see box). “I prefer to invest in stocks that pay a high dividend. In this way, even if there is no capital appreciation, at least you get back what you lost out in bank interest,” says Makani. Rathore and Makani belong to a small, but a highly evolved, tribe of dividend investors.

While most investors are looking for capital appreciation when they buy stocks, these people are also looking for the payouts received from the shares in the form of dividends. Sure, only capital appreciation of the stocks can build long-term wealth, but don’t ignore the power of dividends in this game.

“The dividends dividends augment my income from other sources such as fixed deposits and mutual funds,” he says. For others, dividends help push up the total returns on their stock investments. Total returns include the dividend income while calculating the returns from an investment. Unlike mutual fund dividends, which reduce the scheme’s NAV by that amount, the payouts received from a company are not deducted from the share price.

The share price certainly dips after the record date, but if the stock is fundamentally strong, it bounces back in no time, pushing up the total returns of the investor. It’s like getting a dividend from your mutual fund without affecting the NAV.

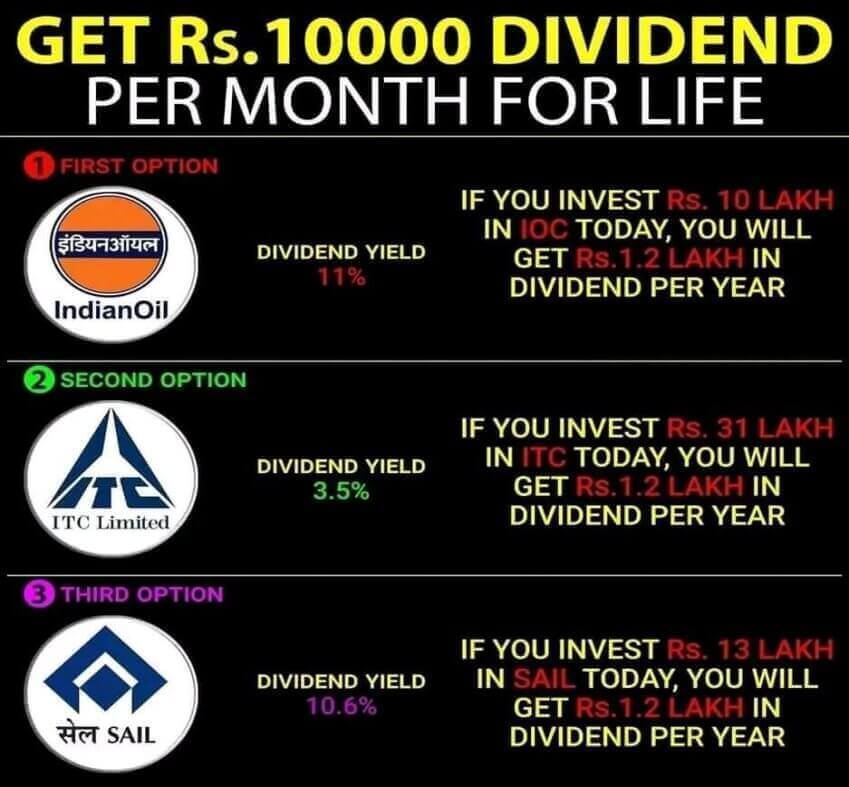

DIVIDENDS OF RS 10,000 PER MONTH FOR LIFE IN THESE STOCKS

INDIAN OIL

Indian Oil Corporation Limited, together with its subsidiaries, engages in the refining, pipeline transportation, and marketing of petroleum products in India. It is also involved in the exploration and production of crude oil and gas, and petrochemicals; and marketing of natural gas. The company’s products include petrol/gasoline, diesel/gas oil, lubricants and greases, auto gas, cooking gas, kerosene, LPG, bulk/industrial fuels, aviation fuel, marine oils, and bitumen. In addition, the company offers special products, such as carbon black feedstock, raw petroleum coke, sulphur, paraffin wax, raw petroleum coke, jute batching oil, micro crystalline wax, mineral turpentine oil, toluene, propylene, benzene, and petcoke.

Further, it engages in the explosives and cryogenic; wind and solar power generation; lube blending; bunkering; refining and pipeline consultancy; and lubricants and base oil marketing activities. The company operates through a network of approximately 9 refineries; approximately 15,000 kilometers of pipelines; approximately 34,559 fuel stations, including 11,026 Kisan Seva Kendra outlets; 120 terminals and depots; 101 LPG bottling plants/terminals; 126 aviation fuel stations; 6,993 consumer pumps; 12,813 LPG distributors; 1,488 CNG stations; 10 lube blending plants; and 2,179 EV charging stations, including 34 battery swapping stations. Its exploration and production portfolio comprises 9 exploration and production blocks in India. The company was founded in 1958 and is based in New Delhi, India.

ITC

ITC Limited engages in the fast-moving consumer goods, hotels, paperboards and paper, packaging, agri, and information technology (IT) businesses in India and internationally. It primarily offers cigarettes and cigars; staples, spices, biscuits, confectionery and gums, snacks, noodles and pasta, beverages, dairy, ready to eat meals, chocolate, coffee, and frozen foods; personal care products; notebooks, pens and pencils, geometry boxes, erasers, sharpeners, rulers, wax and plastic crayons, sketch pens, and oil pastels; apparel, safety matches; and incense sticks under various brands. The company also operates approximately 113 hotels under the ITC Hotel, WelcomHotel, Fortune, and WelcomHeritage brands; and Kaya Kalp spas.

In addition, it offers virgin, recycled, barrier coated, biodegradable barrier, and graphic boards, as well as specialty papers; and packaging products, such as carton board, flexible, tobacco, and green packaging products; and exports feed ingredients, food grains, marine products, processed fruits, coffee products, leaf tobacco products, and spices. Further, the company offers information technology services for the banking, financial services, consumer goods, manufacturing, travel, hospitality, and healthcare industries.

Additionally, it provides property infrastructure and estate maintenance; engineering, procurement, and construction management services; project management consultancy services; business consulting, real estate development, and agro-forestry and other related services; manages and operates golf courses; fabricates and assembles machinery for tube filling; cartooning and wrapping services; conveyor solutions; and produces and commercializes seed potato technology products The company was incorporated in 1910 and is headquartered in Kolkata, India.

SAIL

Steel Authority of India Limited, a steel-making company, manufactures and sells iron and steel products in India and internationally. It offers a range of railway products, which include rail, high YS/UTS rail, corrosion resistant micro alloyed rail, vanadium alloyed rail, end forged thick web asymmetric rail, high conductivity rail, crane rails, and crossing sleeper bars. The company also provides pig iron and pipes; semis, such as tower, baron, spring steel, chain steel, and high carbon; structurals and TMT bars; galvanized steel, wire rods, plate mill plates, and wheels and axles; hot rolled and cold rolled steel; cold rolled sheet/plates; and stainless and electrical steel. Steel Authority of India Limited was founded in 1954 and is based in New Delhi, India.

(Only the headline and picture of this report may have been reworked by the ShareMantras staff; the rest of the content is auto-generated from a syndicated feed.)